Military Home Insurance For Those Serving And Their Families

Save 15% On A Combined Buildings & Contents Policy

Get up to a 30% no-claims discount and a £5 donation to a military charity of your choice when you purchase home insurance for military.

£2,000 of Military Kit and Equipment Cover Included

Protecting your items wherever you are in the world. Plus, up to £20,000 cover for temporary issued kit. Contents covered if staying away from main home. No need for a separate kit policy.

Support A Military Charity Of Your Choice*³

As a Veteran-run business we’re passionate about giving something back and so for every policy sold we will donate £5 to your chosen charity.

Enter our Monthly £50 Amazon Gift Card Giveaway by Confirming your Renewal Date

Not your renewal time? Provide us with your home insurance renewal month and you’ll be automatically entered into our monthly Amazon Gift Card Draw.*¹

You Are Supporting:

Do you live in SLA or SFA?

If you are in Single Living Accommodation or in Service Family Accommodation you need our Military Kit Insurance that also covers your Contents and Personal Possessions.

Military Home Insurance for Serving Military Families

Why is our buildings and contents insurance different?

Trinity’s Military Home Insurance is comprehensive, reliable and competitively priced for homeowners and private renters.

With home emergency cover included as standard, it can help you with urgent repairs to your home if an accident was to occur. If you use the home emergency cover, you won’t see a hike in your subsequent premiums. There are no credit checks, you pay by monthly direct debit or in full for the annual premium, with no charges for any changes you may need to make throughout the policy period.

What are the main features of the product?

As Veterans ourselves, we pride ourselves on understanding our community better than anyone. If you’re currently serving, your military kit (up to £2,000) and temporary issued kit (up to £20,000) are also included so no need for a separate policy.

Your contents are also covered if you are living away from your main home, in the mess or block (SLA).

Can I get a military discount on home insurance?

The premiums you’ll pay for home insurance will depend on a range of factors, including your home, its structure; as well as your location. This is because these can all influence how likely you are to make a claim on your home insurance policy.

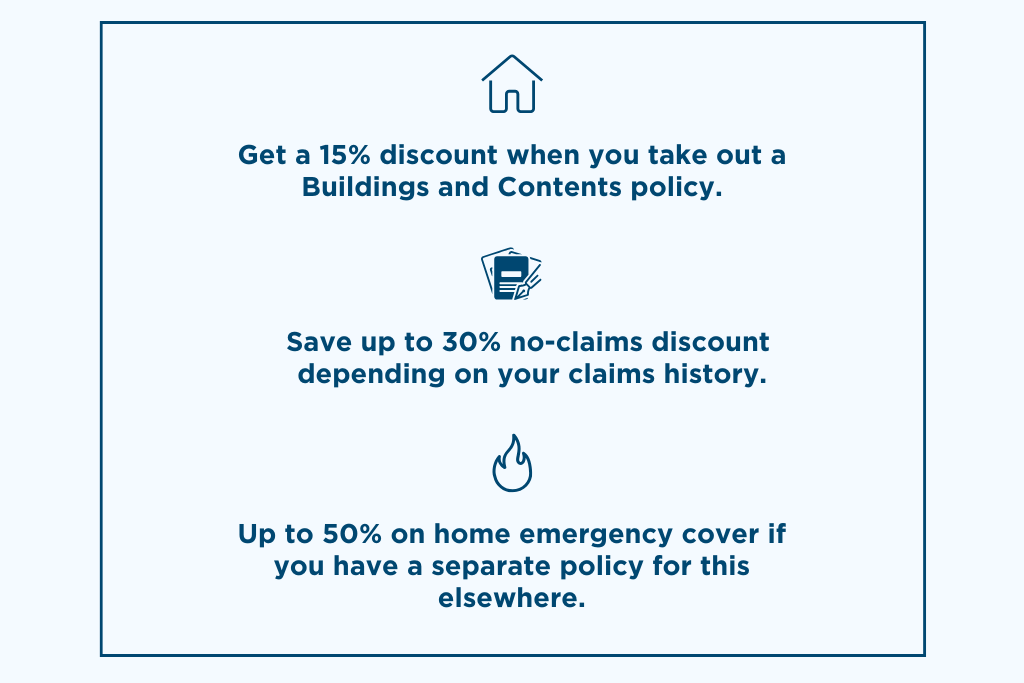

There are a few savings that can be made with this policy:

What’s covered in a Buildings only policy?*⁴

- Loss or damage to buildings including garages and outbuildings caused by extreme weather, theft and more

- Cover for the cost of alternative accommodation or loss of rent (up to 10% of the sum in your schedule)

- Accidental leakage of metered water (up to £2,000)

- Tracing and accessing leaks (up to £5,000)

What's included in a Military Home Contents Insurance policy*⁴

- Loss or damage to your home contents caused by extreme weather, theft and more

- Limited Accidental breakage covering certain contents

- Money in the home (up to £1000)

- Contents belonging to a member of your family at college or university (up to £3,000)

- Pedal cycles in the home (up to £5,000 in total, £3,000 per cycle)

Trust In Trinity.

As a specialist Military home insurance company with over 25 years’ experience, we have been trusted by tens of thousands of your serving and ex-military colleagues to provide protection for them and their families.

From insurance for Life and Critical/Serious illness, Personal Accident insurance or Travel insurance our exceptional service has been rewarded with a 4.9/5 independent customer review rating on Feefo for the last 12 months.

Don't Just Take Our Word For It...

Supporting the whole Armed Forces community.

At Trinity, we are here to support with your protection needs, whatever your stage of life.

What Does Buildings and Contents insurance Help Protect?

Trinity’s Military Home Insurance provides leading protection for your home and belongings if you are serving in the British Army, Royal Navy, Royal Air Force or Royal Marines.

Frequently Asked Questions

Sections 1-6 are underwritten by HCC International Insurance Company plc (HCCII), trading as Tokio Marine HCC. HCCII is registered in England and Wales and is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Firm Reference Number 202655.

Sections 7-8 are underwritten by AmTrust Europe Limited. AmTrust Europe Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority, Firm Reference Number 202189.

Our policy covers Buildings and Contents, Buildings only and Contents only. You might be able to make savings by having a single policy if you need Buildings and Contents rather than separate policies. There is 10% discount for all combined Buildings and Contents policies.

If you rent or you are a non-lease holder, you’ll only need insurance for your contents. As a homeowner (with or without a mortgage), you’ll need buildings and contents.

You can add additional personal possessions that are taken out of the home, up to £20,000. (You have £1000 of cover already included in this policy). You can also add to your policy Accidental Damage cover for one off accidents to your Buildings or Contents.

You can reduce your premium by adding a voluntary excess for your buildings and or contents. If you increase your excess by:

- £50 you can expect to save 5%

- £100 you can expect to save 10%

- £250 you can expect to save 15%

- £500 you can expect to save 20%

Please note that the voluntary excess you select will be in addition to the standard £75 excess (or increased compulsory excess). This will not increase the excess for Subsidence, heave, and landslip. Escape or loss of water, domestic heating oil and gas or Accidental damage claims.

There’s also discounts for taking out combined buildings and contents and claims-free discounts.

For Sections One to Six (Buildings and Contents Insurance)

In the unlikely event you need to make a claim, please contact:

HCCI Claims

Telephone: 0808 175 4908

Email: TRIclaims@tmhcc.com

Claims in writing should be directed to: HCCI Claims, Unit 7 Bocam Park, Old Field Road, Pencoed, Bridgend CF35 5LJ

HCCI Claims handle claims on behalf of HCC International Insurance Company plc. Professional staff are available to assist you whether you need a claim form, advice on emergency repairs or any other aspect of your claim.

For Section Seven (Family Legal Protection)

Telephone: 0344 770 1040 and quote “Trinity Insurance.”

For Section Eight (Home Emergency Cover)

Telephone: 01384 884040

This policy can cover pedal cycles, some limits and exclusions apply. These will all need to be listed, along with an item value. If you need any help call the Trinity team on 01243 817777.

You must tell us that you are moving house, and where you will be living, as soon as possible. Speak to our team on 01243 817777 or email hello@talktotrinity.com.

Yes, mobile phones are covered under Personal Possessions section. Mobile phones are subject to an excess of £75 (or an increased voluntary excess), and we will not pay out any more than £1000 for damage to a mobile phone.

A specified item is an high-risk item worth more than the Unspecified Item Limit (£1000) that you normally wear or carry with you.

Please let us know if you need to add any specified items or are unsure if the items needs to be specified. You can speak to the team on 01243 817777 or email us at: hello@talktotrinity.com

You can speak to the Trinity team on 01243 817777 or email us at: hello@talktotrinity.com

Accidental damage for your Buildings and/or Contents is an option extension to your policy and is subject to a £150 excess for any claims.

For Policy Limits, Exclusions and Other Additional Information, please see the Important Documents section where there are links to the full Policy Wording and the Insurance Product Information Documents (IPIDs).

Important Documents

Discover Our Other Products

Military Life Insurance

Military life insurance is designed for those in the UK Armed Forces, helping you to protect those who matter if you are no longer able to.

Military Personal Accident Insurance

How would your family cope financially if you were involved in a fatal or life-changing accident? Cover tailored to your needs.

Military Travel Insurance

Get cover for personal holidays that includes disruption for unexpected military call up with three cover levels to choose from.

Terms and Conditions

- Provide us with your renewal date for your buildings and contents insurance and you’ll be automatically entered into our monthly Amazon Gift Card Draw. Click here for full terms and conditions.

- Based on online research of four home emergency cover providers that matched (or were less comprehensive) to this cover. October 2023. Trinity’s Buildings and Contents insurance has Home Emergency included as standard.

- For every policy sold we as Trinity, and the Underwriters of the policy, HCC International Insurance Company plc (trading as Tokio Marine HCC), will donate £5 to your chosen charity from those listed.

- Please access the IPID for full details of what’s covered and what’s not covered with this product.